Introduction

Mitigately is a company that is revolutionizing the debt relief and debt consolidation industry by harnessing the power of technology. With a mission to help individuals and businesses eliminate their debt, Mitigately provides effective solutions that make the process of managing and overcoming financial burdens simpler and more efficient.

In a world where debt can significantly impact personal and professional life, Mitigately offers a streamlined approach to solving financial challenges. Through innovative tools and personalized plans, the company helps users navigate their way out of debt and regain control of their financial future.

This blog post will explore how Mitigately works, the benefits it offers, and why it stands out in the crowded market of debt relief and consolidation services. Whether you’re seeking to reduce debt quickly or looking for long-term financial stability, Mitigately could be the solution you’ve been searching for.

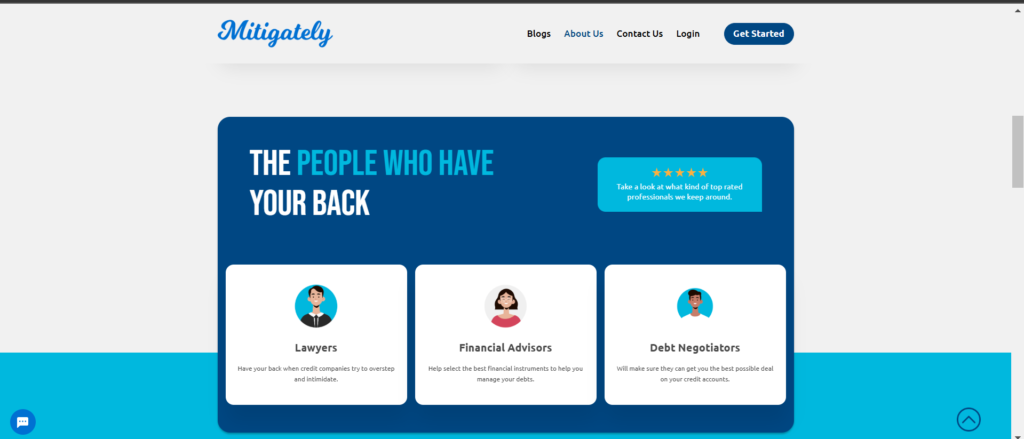

The People Who Have Your Back

At Mitigately, you’re not alone in your journey to financial freedom. Our team of experts is here to support you every step of the way:

- Lawyers

Our experienced lawyers have your back when credit companies try to overstep their bounds and intimidate you. They will ensure your rights are protected and help you navigate the legal aspects of debt relief. - Financial Advisors

Our knowledgeable financial advisors are here to guide you in selecting the best financial instruments to manage and reduce your debt. They will work with you to create a sustainable plan tailored to your unique financial situation. - Debt Negotiators

Our skilled debt negotiators are dedicated to securing the best possible deal for you. With their expertise, they’ll negotiate with creditors to ensure you receive fair terms and reduce your financial burden.

With this dedicated team by your side, Mitigately makes sure you have the expert support you need to regain control of your financial future.

Services We Provide

At Mitigately, we are committed to helping you overcome debt and achieve financial freedom. We offer a range of services designed to reduce your financial burden and guide you on your journey to a debt-free life. Here’s an overview of the key services we provide:

Debt Consolidation

If you’re juggling multiple debts, consolidating them into a single manageable loan can be a game-changer. With our Debt Consolidation service, you can fill out our online assessment, and we’ll work with you to match you with a debt consolidation loan or plan that makes sense for your unique financial situation. Simplify your payments, lower your interest rates, and gain peace of mind knowing that you’re on the right track to becoming debt-free.

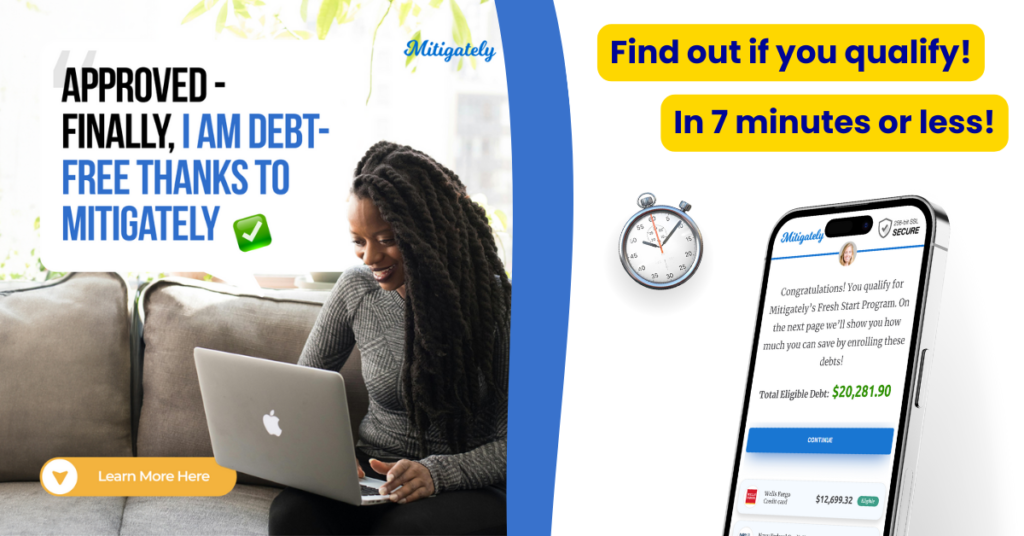

Debt Relief

Our Debt Relief program is designed to help you reduce the amount you owe by negotiating with creditors on your behalf. In many cases, we can help you pay up to 80% less on the debts you owe, with the added benefit of 0% interest. This program is perfect for individuals who are struggling with high-interest rates and overwhelming debt.

Wondering if you qualify? Find out in 5 minutes or less by filling out our quick online form. Let us help you take the first step toward reducing your debt today.

Financial Education Resources

At Mitigately, we believe that financial success doesn’t end with debt relief. Once we’ve helped you get your finances in order, we continue to offer Financial Education Resources to support you in maintaining long-term financial health. Our educational materials provide valuable insights into budgeting, investing, and smart money management, so you can build a solid foundation for a brighter financial future.

Stay informed, stay empowered, and continue your journey toward financial stability with the tools and knowledge we provide.

These services are designed to offer you the comprehensive support you need to not only eliminate debt but also build a solid financial future. With Mitigately, you have a partner who is dedicated to helping you succeed every step of the way.

Types of Debts That Can Be Consolidated

At Mitigately, we specialize in consolidating various types of unsecured debts, making it easier for you to manage your payments and reduce your financial stress. Some of the most common debts that can be consolidated include:

- Credit Cards

If you have multiple credit card balances with high-interest rates, consolidating them into one loan can help you save on interest and simplify your monthly payments. - Medical Bills

Medical debt can quickly accumulate, especially if you’ve had significant health issues. Debt consolidation can help reduce the strain by combining medical bills into a single, more manageable payment. - Personal Loans

Unsecured personal loans can be consolidated to help you lower your monthly payments and get a better handle on your debt repayment. - Certain Types of Student Loans

While federal student loans have their own consolidation programs, certain private student loans can also be consolidated with other debts to streamline your finances.

By consolidating these debts, you can simplify your payment schedule, potentially lower your interest rates, and gain more control over your financial situation. Let Mitigately guide you through the consolidation process and help you take the first step toward financial freedom.

Why Thousands of People Trust Mitigately

At Mitigately, we pride ourselves on the trust and satisfaction of our clients. Thousands of individuals and businesses have turned to us for help with managing and eliminating their debt, and we are proud to have earned their confidence. Here’s why so many people trust Mitigately:

- Proven Track Record

With years of experience in the debt relief and consolidation industry, Mitigately has successfully helped thousands of clients reduce their debt and regain control of their finances. Our approach is rooted in expertise, transparency, and a genuine commitment to improving the financial well-being of every person we serve. - Personalized Solutions

We understand that each financial situation is unique. That’s why we offer tailored solutions to meet the individual needs of our clients. Our team works closely with you to find the best debt consolidation and relief options, ensuring that you receive the most effective and sustainable plan for your circumstances. - Expert Support

Our dedicated team of lawyers, financial advisors, and debt negotiators is always here to guide and support you. Clients consistently praise our knowledgeable professionals for their personalized service, commitment to helping, and ability to secure favorable outcomes. - Positive Client Reviews

Thousands of positive reviews from satisfied clients reflect our dedication to excellence. Whether it’s through reducing their debt by up to 80% or helping them regain financial stability, people trust Mitigately because of the tangible results we’ve delivered. - Transparent and Ethical

We believe in complete transparency, and our clients value our honest and ethical approach. We ensure that all terms, processes, and outcomes are fully explained, so you always know what to expect every step of the way.

Thousands of people have trusted Mitigately to help them eliminate their debt, and we’re proud to continue making a meaningful impact on their financial lives. Join the many others who have found success with us and start your journey to a debt-free future today.

How It Works

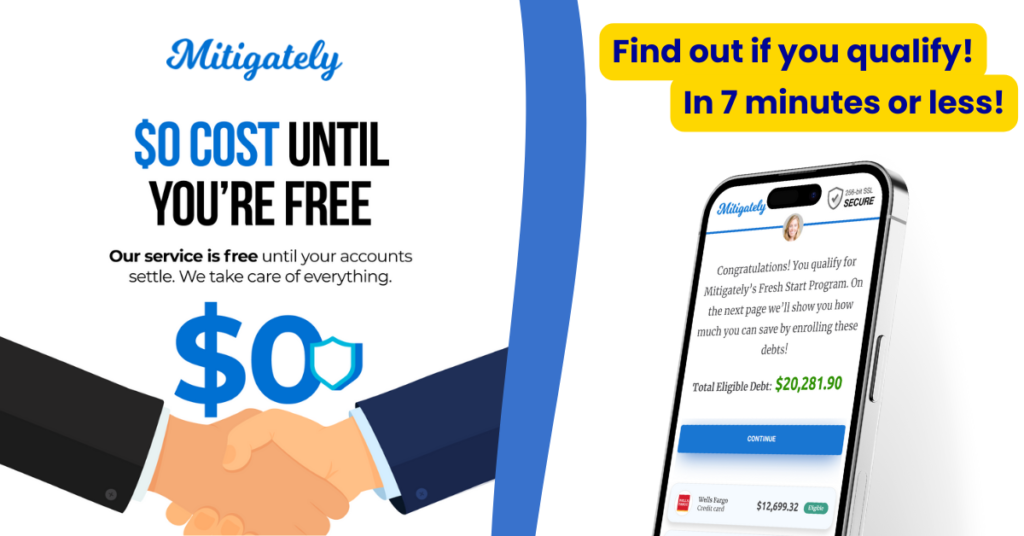

At Mitigately, we’ve streamlined the process of debt relief and consolidation to make it as simple and efficient as possible. Our innovative, AI-powered agent ensures that you get the help you need quickly, securely, and without any unnecessary hassle. Here’s how it works:

01. Getting Started

Start by connecting with our AI-powered agent, a fast, secure, and user-friendly tool designed to gather the necessary details without the need for long phone calls or sharing your information with strangers. Simply input your information and let the technology handle the rest, giving you peace of mind knowing your data is secure.

02. Your Perfect Plan

Once you’ve submitted your details, our AI agent will match you with the best debt consolidation or debt relief plan tailored to your financial situation. Whether you need a debt consolidation loan or a personalized debt relief program, we’ll ensure the solution is the right fit for you, making it easier to take the next steps toward eliminating your debt.

03. The Follow Through

After enrolling in your debt solution, it’s time to follow through with your plan. We’ll take the pressure off your shoulders by negotiating with creditors on your behalf, working diligently to help you save up to 80% on your total debt. You can rest easy knowing that Mitigately is handling the negotiations while you stay focused on sticking to your plan.

04. You Made It Happen

Once your debts are consolidated, you’ll be paying a fraction of what you originally owed. You’ve successfully completed the process and are now on your way to financial freedom! No more multiple payments, no more high-interest rates—just a simple, manageable monthly payment that aligns with your new financial goals.

Get Started Today

Ready to take control of your debt and start your path to financial freedom? It’s easy to get started with Mitigately—just follow the steps outlined above, and we’ll be there to guide you through every phase of your journey. Our secure, AI-driven system is designed to help you make the best decisions for your financial future without the stress of complicated processes.

Don’t wait—take the first step today!